Quick Takes:

- Risk Assets Fall Into Autumn. Risk assets started the fall giving back some of their year-to-date gains as market participants priced in higher interest rates for longer.

- Inflation Bumps Up. Inflation, as measured by the Consumer Price Index (“CPI”), came in slightly above market estimates of +3.6%, landing at +3.7% for the month of August. Despite this hotter than expected reading, the FOMC kept rates steady, but rhetoric took on a decisively hawkish tone. This tone caused market participants to extend their forecasts for rate cuts further into the future.

- King Greenback. The dollar spent the month of September in a steady ascent on the back of the assumption that the Fed will achieve engineering a soft landing for the US economy.

- Economic Production Unrevised, Consumers Taper Spending. The final revision to US GDP for the second quarter came in below market estimations of +2.2%, coming in unchanged at +2.1%. A contributor to this miss in production estimation was Consumer Spending being revised lower from +1.7% to +0.8% for the second quarter of the year as consumers’ wallets continue to feel the pressure of inflation.

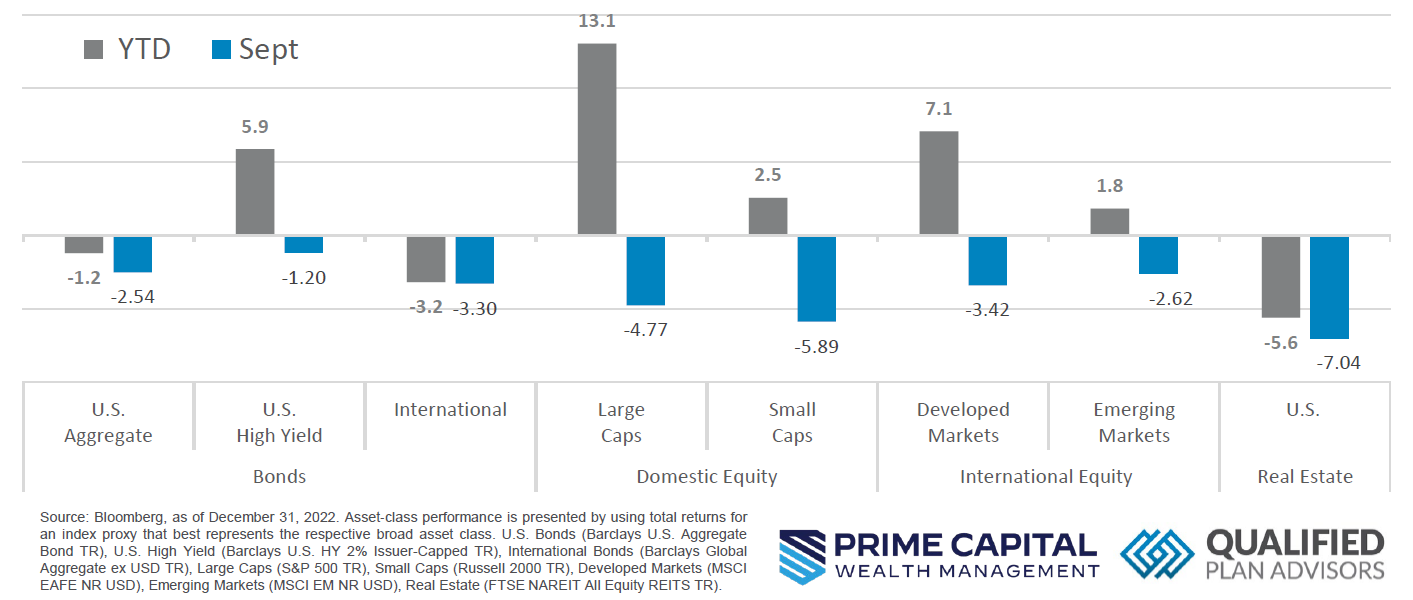

Asset Class Performance

Risk Assets cooled off with the weather as the season transitioned from Summer to Fall. Almost all major asset classes posted a decline for the month of September, many of which are now in the red for the year thus far. Domestic Large Cap equities are still clinging to a double-digit year-to-date gain after their major run-up early in year.

Markets & Macroeconomics

While inflation came in slightly hotter than expected for the month of September, it has spent the majority of the year increasing at a slower pace, i.e., disinflation. The bump in inflation reading for September was largely due to an increase in the price at gas pumps as oil advanced on the back of supply constraints around the globe. Despite the easing pressure in inflation, Consumers are feeling the pain as their wallets continue to be battered by broadly increasing prices post pandemic and subsequent government intervention. Consumers exited the pandemic with balance sheets in pristine condition, flush with government stimulus and steadily advancing wage growth. A wealthy consumer has long been thought to be the saving grace from the Fed’s unprecedented tightening in monetary conditions as they battle entrenched inflation. Consumer Spending is the main driver of the US Economy and so far, has remained resilient despite the burden of rampant inflation and tightening financial conditions. While resilient, Consumers are not immune to the effects of higher prices and interest rates, as evidenced by the revision in second quarter Consumer Spending being nearly cut in half from +1.7% to 0.8%. It appears that consumers have steadily worked their way through the stimulus provided by the government throughout the pandemic and have possibly dipped into savings or tapped lines of credit via credit cards.

With the main driver of the US economy showing signs of moderating, the soft landing scenario may be put into jeopardy. Despite this tapering in Consumer Spending, the Fed’s rhetoric made many market participants rework their base case scenarios, incorporating interest rates being at elevated levels for a longer period of time. While only time will tell if the Fed is using rhetoric to guide markets where they believe it needs to be to win the battle against inflation or if their actions will line up with their public speaking. Regardless, if consumers aren’t able to offset monetary tightening, this could have broad sweeping ramifications for the future state of the US economy.

Bottom Line: Inflation bumped up modestly for the September reading of CPI, but this was mostly due to increase in fuel prices due to tight supply in the oil markets. While this might be temporary, Consumer Spending for the second quarter was revised significantly lower, putting the revised number at +0.8% versus the original estimate of +1.7%. Additionally, recent Fed rhetoric has indicated that monetary policy loosening might be further off than market participants anticipated. Combining tighter monetary policy history with the possibility of lower consumer spending could put the scenario of a soft landing in jeopardy.